4/23/25: WEBINAR | Why would anyone consider refinancing in a higher-rate environment? Register to find out!

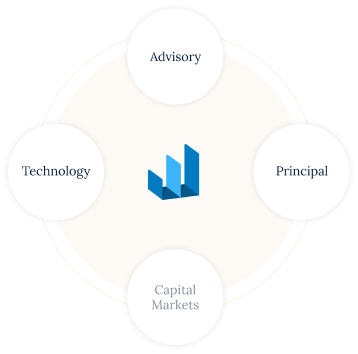

We provide insight & analysis to evaluate and optimize NOI, valuation, and equity returns. Knowing which actions will erode valuation in the market – and understanding your performance in context with the market dynamics – is critical to protecting your returns.

We create efficiencies across the operational & financial management of your assets to protect cashflow and optimize performance. Daily visibility and quick action to improve performance across operations, debt, equity, & risk is key to maintaining strong cashflow and creating returns.

Managing cashflow is key as valuations cool, expenses rise, and markets recalibrate. As the market shifts, efficiency across operations, debt, equity, & risk is critical to the performance of your investment.

Our commitment to CRE runs strong. We’ve invested in commercial real estate interests as a General Partner & Limited Partner over multiple market cycles. We also invest in promising entrepreneurs, syndicators, and real estate organizations to accelerate their growth and create efficiencies by leveraging the Thirty Capital platform.

Our team at Thirty Capital has more than 20 years of experience investing in commercial real estate assets, portfolios, and funds as a General Partner, Limited Partner, and Joint Ventures. Our track record speaks for itself with more than $18B in assets under management. Looking for a partner in your next deal?

Provide your email address to receive regular market perspectives, research, and news from Defease With Ease | Thirty Capital.

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields